The Tax Man! Filling out a Schedule C

Note: This article just explains how I have filed my business taxes for the last several years. It’s based on what I learned in a consultation with an accountant, but I am not an accountant, and this article isn’t tax advice. When in doubt, refer to the Instructions for the Schedule C on the IRS web site.

The simplest way to file business taxes if you are a sole proprietor or LLC is with a Schedule C – this would be in addition to your 1040, and filling out the schedule C before you do the 1040 is wise, as some of the numbers you’ll get at the end of this process will need to go on the 1040.

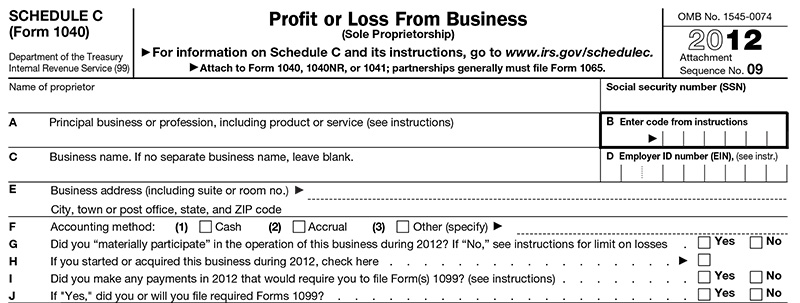

So here’s what the Schedule C looks like, section by section:

Name of Proprietor, that’s you. I trust you don’t need help on that. 🙂

Social Security Number, also something you can handle.

A: Principal business or profession: I put “Childbirth Education and Doula Services” – you will want to adapt that to what you do.

B: This is a code for the type of work you do. There isn’t a specific code for doulas, I have always used 621399 (All Other Miscellaneous Health Care Practitioners)

C: Business Name – fill it in if you use one, leave blank if you don’t.

D: Employer ID Number. Most doulas are not employers, but it is still a good idea to get an EIN. It’s like a social security number for your business. You can use it to open a business bank account, pay taxes, and (most beneficial for doulas) give to your clients so they can apply for insurance or FSA reimbursement, or HSA documentation, and not give out your personal social security number. In these days of rampant identity theft, that alone is worth doing it. You can get an EIN here http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Apply-for-an-Employer-Identification-Number-%28EIN%29-Online – it’s quick, easy and FREE.

E: Address – self explanatory.

F: Accounting method. If you don’t know, you use the cash method. There are other ways, but they are complicated and if you were using a different method, you’d know you were doing it.

G: Since most doulas are a one-woman show, yes, you materially participated. (Saying no would mean you let someone else run the business for you.)

H: Self explanatory. There are some different rules for businesses in the first year of business that allow for greater loss as you incur start up costs, but I don’t know the specifics.

I: Chances are you didn’t do this. A 1099 would be for a contractor employee, investment income you paid to other people, etc.

J: Same as for I above.

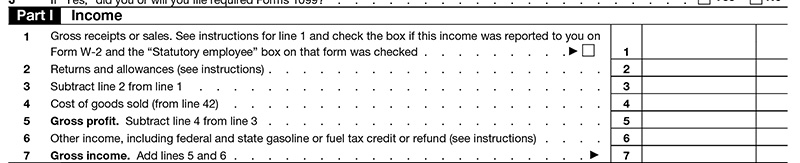

1: This is all the money you received from clients, other doulas, etc. Don’t include anything if you were a traditional employee with taxes withheld. Do include if you were a contracted employee as part of your business and no taxes were withheld. No exceptions, even if you ended up returning the money.

2. If you had to give a client a refund for missing a birth, etc. you put that refund amount here.

3. You do the math.

4. Most doulas are not selling any goods, so this is likely irrelevant. But if you ARE selling goods, put the amount it costs YOU here. So if you buy copies of The Birth Partner in bulk, and give them to your clients, put the amount you spent to buy those books here. Section III on page 2 will need to be filled out as well if you put anything in this box.

5. You do the math.

6. I’ve never needed to use this line.

7. Do even more math and this is your gross income.

8: Advertising – In this area, I include the cost of my web site, printing business cards, etc.

9: Car and Truck Expenses – We’ll have more on this later, but this is your mileage to and from all your doula stuff. In 2012 you get 55.5 cents per mile, which might not sound like much, but in 2012, my mileage deduction totaled $990.35!! (In 2013, it will be 56.5 cents per mile.)

You’ll need to fill out Part IV on the second page if you put anything here. It’s helpful to note your car’s odometer on Jan 1 of every year, and make sure you write down every trip you take that is strictly business. I use a calendar on my office wall. Some use a notebook in the car, or I would imagine there is an app for that.

10: Commissions and fees: Here I deduct credit card processing fees and any other fees I’ve had to pay doing business. Which hasn’t been often.

11: Contract labor: If I have used and paid a backup doula during the year, this is where I deduct that. Remember I’ve already claimed the payment for that birth as income, deducting what I pay the backup here cancels it out. If you pay any one person more than $600 in a calendar year, you have to send them a 1099s for that income. So far I have not ever needed to do that.

12: Depletion – not applicable to doulas

13: Depreciation: If you have a large expense, you can decide to spread that deduction across several years. I’ve never done it for doula stuff, but when I invested in my camera gear, I did spread that expense across several years.

14: If you don’t have employees, doesn’t apply.

15: I carry doula liability insurance, and I deduct the premium here.

16: Interest: I’ve never had an interest deduction, but if you took out a business loan and are paying interest on it, you can deduct it here.

17: Legal and professional services: If you used an attorney to draft your contract, create an LLC, etc. Deduct it. If you hired an accountant to do your taxes, deduct it. (And if you did, why are you reading this, anyway?)

18: Office Expenses Here is where I deduct things like folders for client info, paper for printing handouts, postage, etc.

19: Not applicable to most doulas

20: Unless you rent office space, not applicable. Don’t include your home office. We will get to that.

21: I can’t think of a doula related repair expense, but I have had a few camera repair expenses I’ve put on this line in past years.

22: Supplies This includes lotions and oils for your bag, handouts you buy, etc.

23: Taxes and Licenses I deduct the cost of my business license here.

24: Travel, Meals and Entertainment: When I attend a conference, I deduct airfare, hotel, and meals here. I don’t deduct the conference cost here, I do that elsewhere. I also deduct meals purchased while at births. Note, you only can deduct 50% of the cost of meals!

25: Utilities – the deduction here is ONLY for utilities exclusive to your business. If you have a separate business phone line, you can deduct it here. If you use your family’s home number or your personal cell phone, you can’t deduct it on this line.

26: Only applies if you have employees.

27: Other expenses: This is where I deduct conference fees, professional memberships, and any expenses that don’t fit into the above categories. Part V on page 2 of the Schedule C is a place for listing those.

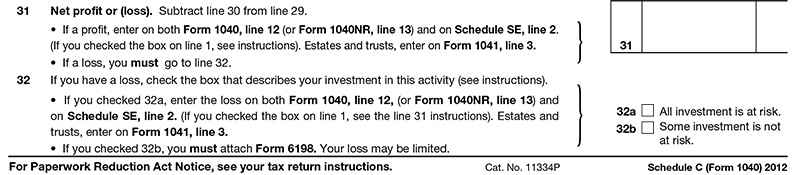

28: Add them all up! Hopefully the expenses are less than the income!

29: Do the math.

30: Home office use. This one can be tricky. The IRS rules http://www.irs.gov/pub/irs-pdf/p587.pdf are pretty clear that in order to deduct the business use of your home, it MUST be exclusively for business and must be identifiable as separate from your living space. So a desk in the corner of your bedroom wouldn’t count, and if you meet your clients in your living room that wouldn’t count, either. But if you DO have a room in your home devoted to your doula work, you can deduct that on this line, after filling out yet another IRS form. But truthfully, it is usually more trouble than it is worth, and the scuttlebutt says it might be a red flag for an audit. And who needs that?

And here we come to line 31 – which is the figurative bottom line, if not exactly at the bottom of the page. What you put here is the total profit or loss, and it gets put over on your 1040. It’s the amount from your business you will pay taxes on.

The second page is kind of an addendum, but you’ll want to make sure you fill it out if you need it.

Like driving a car, it’s much more overwhelming and confusing when you first start doing it, but gets easier over time. I use an Excel spreadsheet to keep track of everything and make a point of updating it once a month to make tax time easier. I actually put it as an appointment on my calendar on the first of every month!

If you’d like to download a blank version of the spreadsheet I use, you can find them here.