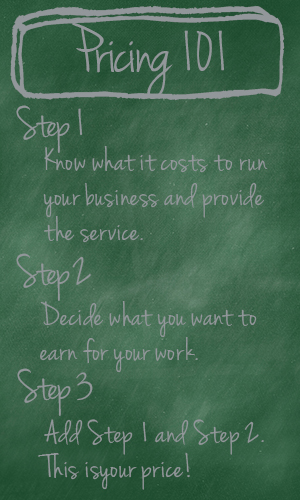

Calculating Your Price

Let’s go over basic pricing. To make your business survive, you need to make certain you are bringing in more than you are spending. One of the best ways to make that happen is to open a separate bank account for your business. You can do it in the business name (recommended) or just another account in your personal name. It might be shocking to you when you isolate the business finances like that. I know it was for me, and was one of the primary motivators for me to figure out the business aspects of this work.

I’ll take you through the steps one at a time, if you want to follow along in a written worksheet, or an Excel Spreadsheet that automatically calculates as it goes through this process, click here to download. (They are under “Useful Free Stuff”)

Step 1: Figure out what it costs to run a business and provide the services

The costs of running a business include:

- Business license If your city or county requires one. I live in Sandy City and for 2013 it was $66

- Name Registration Done through the State of Utah, annual cost is less than $25

- Business Entity – this is optional, and I’ve chosen to be an LLC. Annual cost of renewing the LLC is $15

- Insurance I use the CM&F group, and it is about $80 a year.

- Marketing – This includes costs for your web site (domain name and hosting), buying ads, business cards, and any brochures or other marketing materials you use.

- Professional memberships UDA, DONA International, any others you might join. I find Lamaze International to be a very helpful organization.

- Continuing education Attending the UDA conferences, the Perinatal Professionals Consortium conference, and any others you want to go to. I go to one national conference or workshop a year if I can afford it.

- Office supplies Printer paper, folders for client files, postage if you mail things to your client, etc.

- Supplies for your birth bag – and the bag itself! Lotions, oils, whatever your tools of the trade.

- Mileage for running errands, attending conferences, and going to interviews – because you will not be hired for every interview you go on, I include that mileage here instead of in the cost of providing services. I personally consider going on interviews to be more of a marketing expense than a client service.

Add up all these costs and divide by the projected number of clients this year.

Costs of providing doula services include:

- Mileage for prenatal visits, the birth itself, and postpartum visits. I personally budget for 3 trips to the client’s home (2 prenatals and a postpartum) and two trips to the place of birth. When I am calculating my price, I base it on the farthest I am willing to go, and if the client happens to live around the corner, I have a little more in my business fund.

- Child care I am fortunate enough that I have not had to pay for child care in many years. (One of the best perks of teenage children!!) But when I did, I planned on 10 hours of child care per birth. If my client happened to birth on a weekend, that helped offset childcare costs for those long-drawn out inductions.

- Handouts I have a few handouts and worksheets I use with my clients, and the cost of purchasing or printing those handouts are factored into my costs.

- I know one local doula who factors in the cost of a massage with each birth so she can get the soreness worked out the day afterward. Smart move, but not one I personally have chosen to do.

- If you have a gift you give to every client, or some other personal touch to your doula service, include the cost of that here. (And check with the state tax commission to make sure it doesn’t make your services subject to sales tax!)

Add up all of these expenses and add to the divided cost of running your business.

Step 2: Decide how much you want to earn for your work

This is where there really is no right or wrong answer. I have my own thoughts and opinions, and they are based on things like how much income I want to contribute to my family, what my goals for continuing education are for the year, the amount of time and effort I put into my work, how many clients I want to attract, etc. I personally would rather do fewer births at a higher price to meet my goals than do a lot of births at a lower price.

Another consideration is your experience and skills. I’ve been a doula and childbirth educator for well over a decade, and I have lots of experience. I’ve devoted thousands of dollars to continuing education and further training. I feel that holds more value than a new doula straight out of training, so I set my fees on the higher end of what I think the market will bear.

If you are also a licensed massage therapist and include 5 prenatal and postpartum massages as part of your doula package, your price can be higher to reflect that. If you include 4 postpartum visits, that value – and some profit for that work – should be reflected in your price as well.

Remember that income taxes for business income will be roughly a third of your profit, so don’t forget to factor that in when deciding what you want your take home pay to be.

Step 3: Add together the amounts found in steps 1 and 2. This is your total price for doula work. I recommend rounding up to a nice round number.

If the number you calculated shocks you, and you feel like there’s no way you could charge that, I strongly encourage you to practice saying it out loud. Practice in front of a mirror, practice saying it out loud to friends and family, practice saying it on the phone.

Because (to paraphrase Stuart Smalley)

You’re Good Enough

You’re Smart Enough

and Doggone It!

People Will Hire You!